Car Import Tax Usa

Ship your car to the United States with West Coast Shipping a US based car shipper with over a decade of experience importing carsWe are one of the largest car shipping companies in the US with locations in California and New Jersey. The importation of a brand new car whether brand new or used must pay 40 Customs duty 10 VAT and 0 d or donated the imported vehicle is subject to 40 Customs duty 10 VAT and Ad Valorem.

Importing Cars To The U S Clearit Usa

We handle ground transportation vehicle documentation import clearance and shipping via consolidated and dedicated containers as.

. Importing a Car from the USA to the UK. Its fast and free to try and covers over 100 destinations worldwide. Car imports from the USA to Australia start at a cost of 2395 USD with an estimated turnaround time of 30 days depending on make and model of the vehicle the nearest departure port in the United States and your final destination in Australia.

Any foreign-made vehicle imported into the USA will be have to pay custom duties at the given rates. A motorcycle is taxed 4 a motorcycle is taxed 2. Youll usually have 3 weeks to pay any charges before they send parcel back.

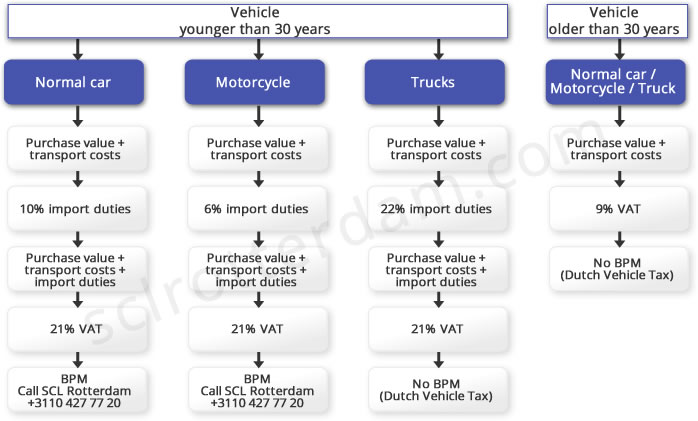

61 tax on non-NAFTA vehicles Toyota Honda Subaru etc Goods Service Tax GST. Import duties 10 for a car and pick-up when lenght of the bin is less than 50 of the lenght of the wheelbase Import duties are 22 for a truck including pick-ups with a bin longer that than 50 of the lenght of the wheelbase. A charged rate of 0-2 is applied.

In total I wont be paying more than roughly 100-120 for import rates and duties. Cost of importing a car. Currently the duty on cars is 25 and the tax on motorcycles is 24 of the price of the vehicle.

If you need to pay import duty on goods from the USA youll be contacted by Royal Mail or your courier and told how to pay. We help worldwide buyers to buy used cars for sale and export them to any country in the world. Essentially this is as follows.

Many of the Canadian vehicles are duty-free. When it comes to import a car from USA we are 1 source for quality American cars. USA-CAR-IMPORTCOM NEW LOW MILEAGE VEHICLES WORLDWIDE DISTRIBUTION.

Calculate import duty and taxes in the web-based calculator. You will have to give these fees and will cost the same regardless of your vehicles condition and purpose of use. The maximum amount of the fee shall not exceed 53840 and shall not be less than 2775.

Below our 2022 car shipping guide will explore everything you need to know about importing cars from the USA to Australia. Is imported for personal use. However there are quite a.

Provincial Sales Tax PST. Youll also need to pay customs duty on gifts or other goods from the USA if theyre worth. Car imports from the USA to the United Kingdom start at a cost of 650 USD with an estimated turnaround time of 14 28 days depending on make and model of the vehicle the nearest departure port in the United States and your final destination in the UK.

Was acquired during the journey from which you are returning. 7 in applicable provinces. Therefore the taxable amount and import rate is 90 3 of 3000.

More Vehicle Shipping Info. The fee is based on the value of the merchandise being imported not including duty freight and insurance charges. The duties are applied whether you are a dealer that is importing multiple vehicles or a private owner that is only bringing one car into the country.

The MPF for formal entries is an ad valorem fee of 03464 percent. As your parcel will be from outside the EU you may be charged VAT or excise duty on it. After the exemption has been applied a flat duty rate of 3 is applied toward the next 1000 of the vehicles value.

So for the good and customs duty youll pay 29820 in total. This local page provides you information of popular cars import regulations taxes shipment. Resident is one who is returning from travel work or study abroad.

Importduties are 27 for a boat and 7 for a motorcycle depending on the country. Exporting a Car from the USA. When importing a car from the America to the UK you can do so completely tax free if you have owned the car for at least six months and have lived outside the EU for over 12 months.

200 fee on all vehicles. For info on any of the above or to discuss your particular shipment call in at. Vehicles imported into the United States will be subject to an import tax based on their price at the time of purchase in the US.

5 of total vehicle value. If these criteria dont apply then cars built in the EU are subject to 50 duty and 20 VAT based on the amount you paid for the car with those built outside of the EU coming in at 10 duty and 20. Buying a car for export is not an easy task you need to consider where a vehicle is posted for sale either it is a car auction or private sale makes a big difference.

Tax will be due on the cost of the goods without shipping which in this case is 28000. Below our 2022 guide will explore everything you need to know about importing cars. To find out how much youll need to pay youll need to check the commodity code for umbrellas and apply the import duty rate for that code 65.

Fill out our Online Quote Form and start your car import to the USA today. For CBP purposes a returning US. US Customs and Border Protection.

How Much Is Import Tax On A Car From Usa. Find out all you need to know to import used quality cars for sale from Japan to USA. 65 of 28000 is 1820.

Autos- 25 Trucks 25. USA Car Import from America and Canada of new and pre-owned cars. There will be merchandising processing fees that are usually a couple of dollar.

Motorcycles- 3 or 34.

The Us Car Trade Deficit Not Just A Matter Of Taxes Jato

Us Tariffs On Car Imports Are A Double Edged Sword European Data News Hub

No comments for "Car Import Tax Usa"

Post a Comment